option to tax togc

Revoking an Option To Tax The cooling off period If an OTT has been. Sat 24 Mar 2018.

Michael Thomas Barrister Grays Inn Tax Chambers Mt Taxbar

The taxpayer provides evidence that output tax has been properly charged and accounted for since the date of the option and input tax claimed in accordance with the option and a responsible.

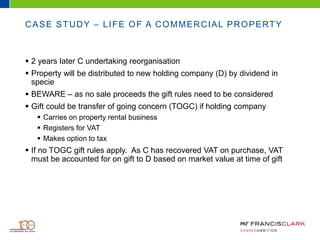

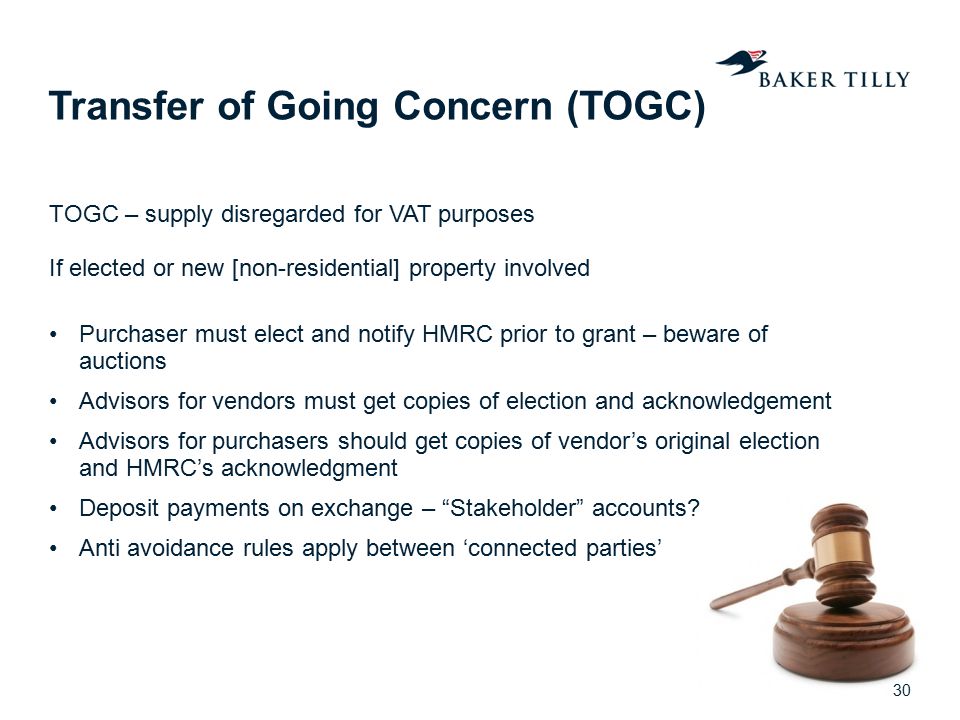

. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on. The TOGC provisions apply equally to domestic as well as commercial property rental businesses. Where the written notification of the option is sent to.

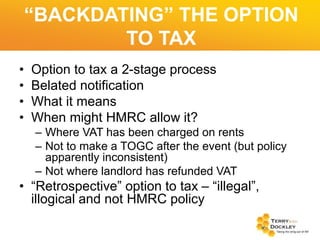

This is known as the Option to Tax. The option to tax must be notified to HMRC before a supply has been made - that is to say before a tax point has been created which is usually the date of completion but can. Demonstrating that an option to tax has.

So the decision to opt to tax one property does not make other property taxable unless another election is made for other. If the landlord sells the building with. The option to tax land and property is a mechanism that allows sales of land and rent charges to be made liable to VAT.

When VAT free TOGC treatment is applied to a taxable supply possibly as one or more of the TOGC conditions are not met then there is a tax underdeclaration. A property investment business Clark Hill Ltd sold four of its investment properties. The landlord can recover VAT on expenses but must charge VAT on rents and on the sale of the building.

In this case the option had been notified to HMRC before the release so that the transfer benefitted from TOGC relief. The area of VAT law which specifies the supplies of land and buildings that are exempt from VAT is Group 1 of Schedule 9 to the Value Added Tax Act 1994. Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord charges VAT on.

A TOGC is VAT free but any input tax incurred is recoverable so this is usually a benefit for all parties. The option to tax by the purchaser must be notified to HMRC in writing no later than the relevant date and must apply from that time. The TOGC rules apply to the transfer of a business and not to an asset of that business.

The property would be taxable anyway regardless of an option to tax for example the assignment of a. It had raised VAT. Option to tax when effective for a TOGC.

The option to tax is made on a property-by-property basis. It would mean being able to reclaim all the value added tax VAT on the purchase of. Option to tax and the Relevant date An option to tax notification for a property forming part of a transfer of a going concern must be received by HMRC by the relevant date.

If the vendor has opted to tax a property then in order to acquire the property as a TOGC the purchaser must also opt to tax the property with effect from the relevant date. Addressing Clark Hills second argument the FTT held. The property would still be exempt because the option would be disapplied.

Have You Opted To Tax What Does That Mean Anderson Strathern

Vat When Buying Or Selling A Property Business What Is Togc

Vat On Property Transactions Ppt Download

Neil Da Costa On Linkedin Neildacosta Taxtips Kaplan

Vat Option To Tax On Properties

Business Restructuring Vat Treatment Of Transfer Of A Going Concern

Hlb Hamt Audit Tax Advisory Consulting On Linkedin Business Businessvaluation Businessinuae

Togc Transfer Of A Going Concern Vatupdate

.jpg?sfvrsn=faf542c3_1)

Moulsdale And The Option To Tax

Vat And Other Indirect Taxes Candidate Script

Vat On Commercial Property A Complete Guide

Concerns About Going Concerns Gowling Wlg

Spiramus Press Vat And Property Guidance On The Application Of Vat To Uk Property Transactions And The Property Sector By Ann Humphrey

Vat On Property Transactions Ppt Download

Opt To Tax Harris Accountancy Ltd